|

THE FORECLOSURE SOLUTIONS GROUP & Danny Hammond We Can Help You Save Your Home, Or Recover It!

You Can Also See Danny Hammond Speaking His Mind At "Deep Thoughts While Staring At A Wall"

Tuesday, December 23, 2025

What If Your Wrongful Foreclosure Was Already Void, But You Were Unaware Of This Fact?

Wednesday, December 17, 2025

GROUP #1 Watch This Space For Newly Scheduled Workshop Sessions and/or FAQ Questions Open To Anyone "WHERE DO WE GO FROM HERE?"

Friday, November 28, 2025

Details For Phase I and Phase II of the Save Your Home Lawsuit Workshops

The biggest mistakes that cause people to lose before they even start

The constitutional principles that apply in federal court and state courts whether they like it or not How to spot fraud and build your own evidence trail The exact step-by-step strategy to follow when filing in court, and which court and why. How To Finish The Evil Thing! When Phase I is finished you will understand what strategies we are using and why. You will have, at the worst, a 1st draft, of your Complaint (Lawsuit). We will review it and tweak it if it needs it. We will support your questions while you are actually filing your Complaint in Court. Click The Line Below To: |

Danny Hammond BIO

Monday, October 13, 2025

The Constitutional, Irreducible, Minimum Requirements of Article III Standing As Defined By the The United States Supreme Court- From "The Pro Se Series" by Danny Hammond: Foreclosure Fraud Primer 101 #4

The United States Constitution

by Danny Hammond of the 3/4 Court Press

|

The judge promised when he took the job that he, or she, would enforce and protect the laws that come from the constitution and that they would defend the public perception of the court ferociously in order to keep from losing the public trust in the integrity of the court.

Maybe that was too much to ask from some pompous asses. Why did we all expect more of judges and attorneys anyway? If I am any part of the public, then I can tell you for sure, the courts have already lost some of MY public trust.

It is difficult for me to pull Borrowers back from their searches for Promissory Notes, and the Assignments of Mortgage, MERS, PSA, etc., etc., thinking like Dick Tracy and Perry Mason, as well as Captain Kirk looking for a way to "prove" that the party trying to foreclose on them does not have the RIGHT or, STANDING, to do so.

The Borrower Can Challenge The Assignments Of The Security Instruments [mortgage, deed of trust, trust deed etc.] Pursuant To The Rulings In "Slorp": The Full Case is Included Here

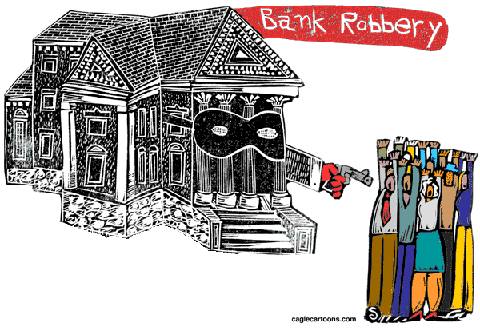

ALL OF THE FORECLOSING PARTIES HAVE BEEN USING THE WORN OUT INTERPRETATION OF LAW, SAYING "THE BORROWERS CANNOT CHALLENGE ANY ASSIGNMENTS OF THE MORTGAGE". BUT, MORTGAGE FRAUD CHANGES ALL OF THAT ACCORDING TO THE SIXTH CIRCUIT APPEALS COURT IN "SLORP"!

Republished by Danny Hammond of the 3/4 Court Press

mtgfrd.workshops@gmail.com

|

The Imposter Foreclosing Party almost always claims that the Borrower (as the mortgagor) cannot challenge assignments. You did make your Promissory Note negotiable according to the terms of your Promissory Note that you allegedly signed. That is why the foreclosing parties use this interpretation.

But did the foreclosing party buy it legally? No almost assuredly it was never involved in a purchase and sale transaction which even involved any real purchase of your debt.

I Used To Have A List Of All Of The Bad Guys I Have Dealt With In Support Of My Foreclosure Clients. I Did Not Find The Full List Yet. But, I Am Posting What I Did Find Here Today. I Don't Know Why.

Is What It's All About?"

MORTGAGE FRAUD: It Is A Straight Line! Your Entire Fraudulent Foreclosure Case Is Based On A Straight Line With No Gaps. But In Today's Corrupted System There Are Always Unexplainable Gaps.

"I have complete faith in the continued absurdity of whatever's going on."

Thursday, September 18, 2025

A Question From The Comments Section of Our YouTube Channel: "Is It True, That State Laws Allow A Foreclosure To Take Place Without The Foreclosing Party Producing The Note?"

An escalator can never break,

It can only become stairs.

You should never see an "Escalator Temporarily Out Of Order" sign,

Just "Escalator Temporarily Stairs" "Sorry for the convenience"

Mitch Hedberg

Monday, April 7, 2025

From "The Pro Se Series" by Danny Hammond: BORROWERS AS PRO SE WIN BIG FORECLOSURE FRAUD LAWSUIT AND GET THE HOUSE PLUS $2.5 MILLION DAMAGES

"Turn this thing around,

Wednesday, March 5, 2025

Tuesday, March 4, 2025

LET'S ALL JUST TAKE THREE STEPS BACK FROM CRAZY! THAT IS RULE #1-- WHEN FIGHTING MORTGAGE FRAUD: Carpenter v Longan 1872; [Also On YouTube Channel] @mtgfrd

Heirs of a cold war, that's what we've become, Inheriting troubles, I'm mentally numb

The Supreme Court settled the matter of assigning a mortgage or deed of trust in 1872. You can't assign those instruments. The case is CARPENTER V LONGAN AND THE CASE IS IN THIS ARTICLE JUST BELOW.

Find out why any assignment of the security agreement is void. Keep reading.

IN THE 26 STATES THAT USE NON-JUDICIAL FORECLOSURE THE MORTGAGE IS CALLED A DEED OF TRUST. THE WORD MORTGAGE IS RARELY SPOKEN IN THESE STATES.

In Judicial foreclosure states, the assignment of the security instrument involves what is called a mortgage. A mortgage is not a home loan. It is merely the rule book concerning the collateral you put up to ensure that the bank will be paid back.

A mortgage has no value and the assignment of a mortgage does NOT transfer your home loan from one party to another. In the Non-Judicial States, the security instrument is called a Deed of Trust which serves the same purpose as a mortgage. There is no such thing as "the assignment of a mortgage or a deed of trust. The mortgage or deed of trust exists only as part of the loan agreement and it is incidental. The security instrument is known as the incidental instrument (there are no laws that require collateral for a loan at all.)

Your house is the usual collateral involving a home loan because that is where the loan money was spent. But, collateral could also consist of one thousand Schwinn bicycles in a warehouse. It is my strong personal belief that all (ALL) of the foreclosures in the United States from about the year 2000, or earlier, are based on the exact (EXACT) same lie. What is that lie?

CARPENTER V LONGAN (SUPREME COURT 1872) THE ENTIRE RULING IS NEXT

Monday, March 3, 2025

US Bank, Its Trust Department, Or Its Meddling Henchmen Have Been Showing Up In 3/4 Of All Of Our Foreclosure Cases In The Last Few Years. Are They A Criminal Operation?

Yes, They Are a Criminal Organization.

In the battle to defend your home from wrongful foreclosure, homeowners often find themselves up against big names like U.S. Bank, Deutsche Bank, or Bank of New York Mellon. These “trustees” appear on foreclosure documents, often leading homeowners to believe these institutions are actively managing their loans and directly pulling the strings in the foreclosure process. But here’s the truth: *They’re not*.

We have been using a US Bank Trust Department marketing brochure for years that makes their role as a loan trustee or a mortgage-backed security trustee (the word trustee has many meaning in foreclosures. This confuses Borrowers and it is intentional. But, the marketing brochure put out by the US Bank Trust Department makes what "CAN'T HAPPEN" crystal clear. It’s like hearing from the horse’s mouth that the supposed power these trustees hold over your mortgage is largely a facade. This document exposes a shocking reality that many homeowners – and even their attorneys – don’t fully understand. Let’s break it down.

In U.S. Bank’s own words, as a trustee for Mortgage-Backed Securities (MBS), they perform a narrow set of duties:

Saturday, March 1, 2025

THE FHFA IS A CONSERVATOR … NOT A RECEIVER, COURT RULES! THEREFORE FANNIE MAE AND FREDDIE MAC ARE "NOT" STATE ACTORS

"When they call the roll in the Senate, the Senators do not know whether to answer 'Present' or 'Not guilty.”

Theodore Roosevelt

- What it does:

- The FHFA is an independent agency that regulates and supervises Fannie Mae, Freddie Mac, and the Federal Home Loan Banks. The FHFA's mission is to promote a safer and stronger housing finance system in the United States.

- How it's funded:

- The FHFA is funded by a portion of the budgets of Fannie, Freddie, and the FHLBanks.

- Who leads it:

- The Honorable Sandra L. Thompson is the Director of the FHFA. She was sworn in on June 22, 2022.

- What it's responsible for:

- Ensuring the regulated entities operate in the public interest

- Addressing barriers to sustainable housing opportunities for underserved communities

- Overseeing the fulfillment of the statutory purposes of the regulated entities)

- Promoting the safety and soundness of the regulated entities

- Danny Hammond Version: The United States formed this entity to protect Fannie Mae (FNMA) and Freddie Mac (Federal Home Loan Mortgage Corporation (FHLMC)) from being sued by victims of their illeagal actions which facilitated millions of the fraudulent foreclosures.

- Fannie Mae foreclosed on $5 million worth of investment property that my wife and I had worked very hard on and and with earnings from other real estate projects we were able set the money aside to build these properties and we paid cash and had no loans.

Friday, February 28, 2025

Fraudulent Foreclosure and the Danny Hammond MIKE SINGLETARY Offense For Borrowers Facing Fraudulent Foreclosure

Vince Lombardi

by Danny Hammond of the 3/4 Court Press

The theory behind my "Mike Singletary Mortgage Fraud Offense" begins with the premise that in your foreclosure court there are some nameless players who aren't really affecting the game as much as you think.

You are not going to win if Mike Singletary continues to play.

Wednesday, February 26, 2025

Accounting Of The Foreclosure Sale Proceeds, Credit Bid and; Deficiencey Or Surplus Due To The Borrower

Paraphrasing of ― Raymond Chandler, The Lady in the Lake

If you would like to have us evaluate your situation free please fill out this form:

Wednesday, February 5, 2025

If You Believe In Borrowers Getting A Modification To Protect Them From Foreclosure, I Have A Unicorn In My Basement I Might Be Willing To Sell

The strings are breakin' but you can't say no

You're runnin' with the devil and it's touch and go

|

| by Danny Hammond of the 3/4 Court Press |

Everyone that calls me passed this part according to the rules given to them. Pay 3 month on time. Then the wickedness sets in. All sorts of "reasons" begin to be received by the Borrower regarding why their trial failed.

Most are absurd. They are relating experiences like telling the Borrower he did not pass the 3 months of payments, when he did.

Or the Borrower did not respond in the right amount of time.

Or the Borrower used the wrong means of notification to the (usually the Servicer), whatever that means at that moment. Or the Borrower used the wrong form, and the particularly nasty, your Servicer has changed and you must start over.

My client right now who we are about to file into state court, was told every one of these things above. She is stilled scared to death it is going to be a problem in the Lawsuit or Petition as a lawsuit is called in Missouri. Read More

mtgfrd.workshops@gmail.com

If you would like a free evaluation of your situation click here

Wednesday, December 18, 2024

Wednesday, June 19, 2024

The Truth of the Matter, The Thing Itself, There is No Other THING, Because The Truth of The Matter, Is That You Were Foreclosed On With The Assignment of Your Mortgage Or Deed of Trust.

This Is Not Possible in Law or Magic

Groucho Marx

of the 3/4 Court Press

This was a strange evening. I woke up in my recliner at 6 pm, only I thought it was 6 am. So I got up and had some breakfast, found out what my Ukrainian friends had accomplished, and began to read emails then I noticed it was 7 pm and I didn't now know, if it was the day before or the day after. Then I realized that I was asking myseslf that question but I didn't know what I meant by after.

But, it was about to get weirder.

The very first email I opened generated the following response from me. It had to do with an affidavit by a "not so much" expert witness. It seems the Fake Foreclosing Party had lost the mortgage (or deed of trust depends on where you live, Reader). The expert witness was asking for a new mortgage so that it could be assigned (wtf?) because the real mortgage had been lost.

If you have read anything here and retained it, then you know that you can't lose a mortgage and that the assignment of your security instrument (mortgage, deed of trust, security deed etc.) simply cannot be done. That it is not even that kind of a document. READ MORE

.png)