|

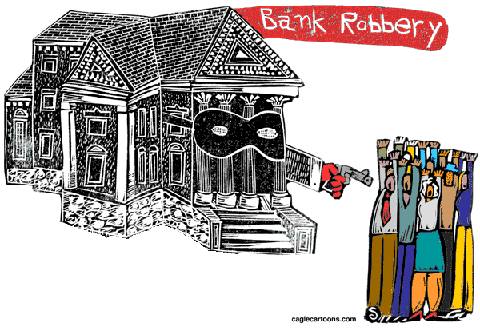

| How Do These Foreclosure Mills Keep Getting Those Incredible Hands? |

By Danny Hammond of the 3/4 Court Press

I have spent 15 years fighting the racketeers.

First in my ever escalating overview of the sheer size of the scheme, the lack of participation of a government and a judiciary designed by a Constitution as brilliant as mere mortals could possibly attain. Especially if you study that the framers were not especially cohesive.

They were more of a kind of a gaggle of characters with a withering number of separate agendas and motivations. But, overall they were a brilliant bunch with a common cause that kept their eyes on the ball.

It is true that some hated each other. But they did not have the debilitating number of distractions of modern times.

Most importantly their quieter world gave them a greater understanding of human nature.

The Constitution has been described the most brilliant document in world history.

A Democracy needs protection and vigilance. We are drifting away from our paramount duty to follow it and insist that those who we voted for to work for us as their employer don't become rich and fat on illegal work and looking the other way like a Keystone Cop.

Until 16 months ago I was dealing with individual families one at a time. They just wanted me to take over their problems and solve them. Like a tax guy. Or whatever metaphor you would use.

These clients were too busy to learn anything. They had a family and a job and a little more money

I did not start this as a business.

I had lost more money to foreclosures, than any 20 Borrowers combined.

I was facing the same problems of dealing with a government and a judiciary that seemed to be incomprehensibly unaware of laws, rights, and criminal activities. The courts and the Judge were either stupid or they were unaware for the moment, but soon they would be aware and silent.

I was 17.

I didn't just get the knowledge and information from a lightening strike.

My dad almost forced me to do it. He was preparing me to recognize opportunities and then find solutions to achieve positive returns.

It isn't his fault, how could he know? But, he didn't teach me what to do about worldwide crime, which would not come up until the period of 1999-2006 (the Congressional Repeal of the main regulation over Wall Street of the Glass-Steagall Finance Act of 1934.

Glass-Steagall kept the U.S economy mostly safe and sound for nearly 70 years. No withering U.S. economic earth shattering breakdown for nearly 7 decades.

After the 1999 Repeal of the Act, it was only 5 short years to an apocalyptic economic upheaval causing a massive transfer of wealth from the middle class to the rich 1%, that never has been fixed.

This has created an environment so bizarre that an idiot with no moral compass, no detectable intellect, no social skills and an orange face was elected POTUS by people not being held hostage or being tortured. (Leave me alone on this. I met the man in New York in 1984. He wanted to hang around with a friend and I and came looking for us at 4 pm daily for awhile. We developed escape techniques that American pilots in German POW camps would have at least considered.)

There is no one working on a fix. As a nation we have all been distracted by jobs, money, healthcare, the future of our children and conversely, the cost of Kindercare.

We might have limited the damage by just giving all of Congress and all of the judges boats right at the gitgo.

I4 months ago, after I had quit foreclosure help for two years because I needed to concentrate on my career as a Real Estate Consultant because I had used so much of my time in the foreclosure problem, which brings in some money but I have always subsidized it with my money.

I charge a hopelessly low fee. I can't make myself take on only Borrowers (who have been drained of money by attorneys also) who can pay it, and leave Borrowers who have, but not of their own making, used up a prohibitive percentage of their cash and can only plead that they will find a way to pay later.

I am not feeling it. I look on the Internet and I find no one doing what I am doing. I do see scams trying to cheat Borrowers.

I have a few collaborators with different skill sets I work with and I couldn't have finished the process before I was hauled away to the poor house without their help.

Will a tall dark stranger come in to help us or will someone figure something out if I haven't? I don't know. I don't see how. The battle lines have been drawn on bribes and corruption.

We are up against something much less than brilliant, but massive and hidden in the large number of cardboard Disney characters they use to get you to look the wrong way at the right moment, this and right along with a near total lack of judical or Congressional oversight.

I have taken on no Borrowers for my old one at a time strategy. I did use that during the streak.

We had newly constructed properties bringing in rental income that we never had loans on.

Fannie Mae foreclosed on properties that had no mortgage, it took them 5 years. At that time no one could sue Fannie Mae because because they were part of the government.

Fannie Mae has recently lost 4 lawsuits with rulings that they were not part of the government.

I can sue them right now. I can get damages of 3 times 10 years of taking my rent and the deferred maintenance of my buildings. If I win. I have to take the risk that I may not win. Everyone must take the same odds as me.

Just for clarification, I think 24 hours a day about this subject. I was 56 years old in 2008 when this all started. I am 73. Too old for this shit.

My cases and your cases are all just alike once you have seen enough them.

Fannie Mae is kind of an unknown.But, I am optimistic. Most of the others around me are not unknown. Those I can look at with much more knowledge and lots of weapons.

I have never seen one case where the Foreclosing Party even attempted to prove that it, or they whatever, it had met the Constitutional, Irreducible, Minimum Requirements of Standing.